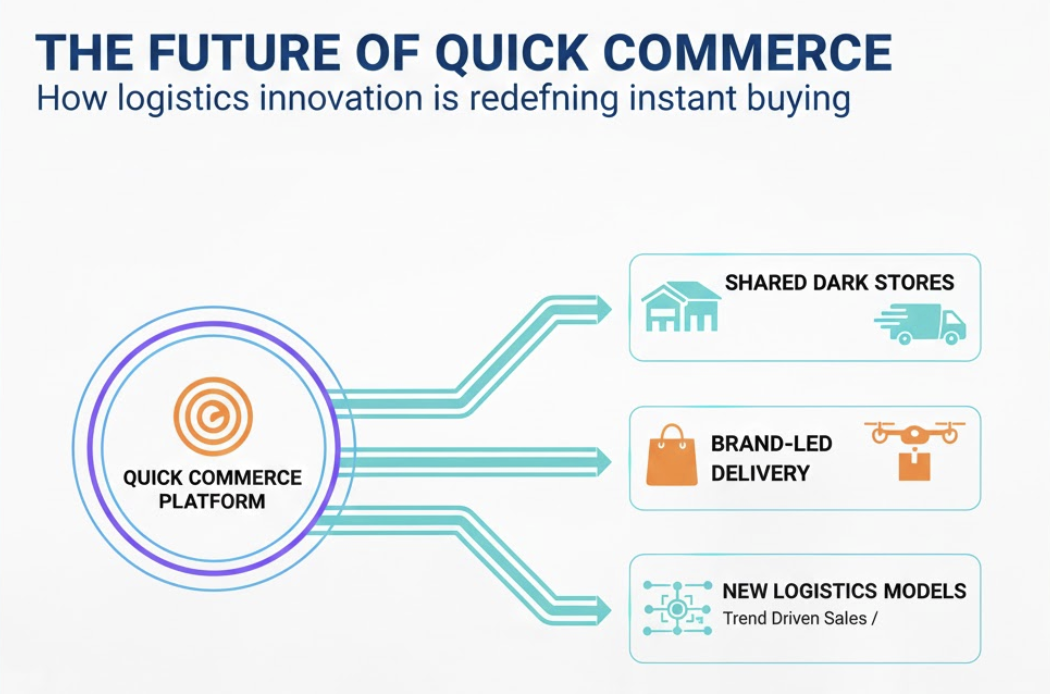

The future of quick commerce in digital retail is entering a new phase. What started as 10-minute grocery delivery is now becoming something bigger, deeper, and more competitive. Earlier, quick commerce was driven mainly by platforms. Today, however, brands themselves are preparing to step in.

Consumers have changed their expectations. They no longer see fast delivery as a bonus. Instead, they see it as a default. Because of this shift, quick commerce is moving from a platform-led model to a brand-enabled ecosystem.

At the same time, cost pressures are increasing. Last-mile delivery is expensive. Dark stores are capital-heavy. Therefore, the next iteration of quick commerce will depend heavily on shared infrastructure, common dark stores, and plug-and-play logistics networks.

This article explains where quick commerce is heading, why shared infrastructure is the next big unlock, and how founders and brands should prepare.

Understanding the Future of Quick Commerce

To understand the future of quick commerce, it helps to look at how the model is evolving.

Earlier, quick commerce focused on:

- Groceries

- Daily essentials

- Hyperlocal delivery

However, the scope is expanding. Categories such as personal care, electronics accessories, medicines, and even fashion basics are entering the quick commerce funnel.

Why Consumer Behavior Is Driving This Shift

Consumers value speed because it reduces friction. Moreover, instant delivery often converts impulse intent into actual purchase. As a result, quick commerce is no longer just about convenience. It is about capturing demand at the moment it arises.

How the Future of Quick Commerce Is Moving Beyond Platforms

Initially, quick commerce was dominated by large platforms like Blinkit, Zepto, and Swiggy Instamart.

However, the future of quick commerce will not belong only to platforms.

Why Brands Want Direct Control

Brands want:

- Better margins

- Direct customer data

- Control over experience

Therefore, many brands are exploring direct quick delivery, either independently or through shared networks.

This shift mirrors what happened in ecommerce, where brands moved from marketplaces to D2C models.

Shared Infrastructure: The Backbone of the Future of Quick Commerce

The biggest constraint in quick commerce is cost. Because of this, shared infrastructure is emerging as the most viable solution.

What Shared Infrastructure Really Means

Shared infrastructure includes:

- Common dark stores

- Shared fulfillment centers

- Third-party last-mile logistics

- Technology platforms for routing and inventory

Instead of each brand building everything, they plug into existing systems.

Why This Model Makes Economic Sense

Shared infrastructure:

- Reduces capital expenditure

- Improves asset utilization

- Enables faster scaling

As a result, even mid-sized brands can enter quick commerce without burning cash.

The Role of Dark Stores in the Future of Quick Commerce

Dark stores are central to the future of quick commerce. However, their role is evolving.

From Brand-Owned to Multi-Brand Dark Stores

Earlier, platforms operated exclusive dark stores. Now, the trend is shifting toward multi-brand dark stores.

These stores:

- Serve multiple brands

- Optimize inventory rotation

- Reduce per-order costs

This change makes quick commerce more sustainable.

Location Strategy Becomes Critical

Dark stores must be:

- Close to high-demand clusters

- Optimized for picking speed

- Integrated with routing systems

Poor location planning can kill margins fast.

Logistics Networks and the Future of Quick Commerce

Logistics will decide winners and losers in the future of quick commerce.

Why Last-Mile Efficiency Is Everything

In quick commerce, delivery cost per order can decide profitability. Therefore, logistics networks must focus on:

- Route optimization

- Order batching

- Rider productivity

Shared delivery fleets will become more common as brands seek efficiency.

Technology as a Differentiator

Advanced logistics tech helps:

- Predict demand

- Allocate inventory dynamically

- Reduce delivery times

Without strong tech, quick commerce simply does not scale.

How the Future of Quick Commerce Changes Brand Strategy

Quick commerce forces brands to rethink their entire funnel.

From Awareness to Instant Conversion

Traditional ecommerce follows a long journey. In contrast, quick commerce compresses the funnel:

- Awareness

- Intent

- Purchase

All happen within minutes.

Product and Pricing Adjustments

Brands must:

- Optimize SKUs for quick delivery

- Adjust pricing for speed convenience

- Focus on high-turnover products

Not every product suits quick commerce.

Measurement in the Future of Quick Commerce

Measuring success in quick commerce requires new metrics.

What Brands Should Track

Instead of only revenue, brands should track:

- Order frequency

- Delivery success rate

- Time-to-delivery

- Repeat usage

These metrics reflect long-term viability.

Avoiding Vanity Metrics

Downloads and app installs mean little if users do not reorder. Therefore, retention becomes the real growth lever.

Common Mistakes Brands Will Make in Quick Commerce

Despite the opportunity, mistakes are inevitable.

Mistake 1: Expanding Too Fast

Scaling before demand stabilizes increases losses.

Mistake 2: Ignoring Unit Economics

Speed without profitability is dangerous.

Mistake 3: Treating Quick Commerce as Just Another Channel

Quick commerce requires dedicated operations, not recycled ecommerce playbooks.

Regulatory and Compliance Considerations

As quick commerce expands, compliance becomes more important.

Brands must ensure:

- Proper business registrations

- Clear pricing and tax compliance

- Transparent consumer policies

Founder’s View: Why the Future of Quick Commerce Is an Opportunity

For founders, the future of quick commerce offers a rare chance to compete with incumbents.

Because infrastructure is becoming shared, differentiation shifts to:

- Product quality

- Brand trust

- Operational discipline

Speed alone will not win. Smart execution will.

Read Previous Article on Startup Guides India.

Strategic Takeaway on the Future of Quick Commerce

The future of quick commerce will not be about who delivers fastest at any cost. Instead, it will be about who delivers smartly and sustainably.

Brands that embrace shared infrastructure, optimize unit economics, and focus on repeat usage will thrive.

Conclusion: Preparing for the Next Phase of Quick Commerce

The future of quick commerce in digital retail is moving toward collaboration, not isolation. Shared dark stores, common logistics, and brand-led participation will define the next wave.

To prepare:

- Design products for instant delivery

- Partner instead of building everything

- Track profitability from day one

In the next article of this series, we will explore how AI-driven demand prediction is transforming supply chains and last-mile delivery, with real-world examples.

FAQs: Future of Quick Commerce in Digital Retail

1. What is meant by the future of quick commerce?

It refers to the evolution of instant delivery models using shared infrastructure and brand-led participation.

2. Why are shared dark stores important for quick commerce?

They reduce costs, improve utilization, and allow multiple brands to scale without heavy investment.

3. Will brands directly offer quick delivery in the future?

Yes. Many brands are exploring direct quick delivery using third-party logistics networks.

4. Is quick commerce profitable?

It can be, but only with strong unit economics, high repeat usage, and operational efficiency.

5. How should startups prepare for quick commerce?

Start small, focus on high-demand SKUs, and leverage shared logistics instead of building everything.