One of the most common dilemmas Indian founders face after finalising their business idea is choosing between a Private Limited Company and an LLP (Limited Liability Partnership).

At first glance, both structures offer limited liability and legal recognition. However, when you go deeper into taxation, compliance, funding capability, and long-term growth, the differences become significant.

This article provides a clear, side-by-side comparison of Private Limited Company vs LLP in India, helping you choose the structure that truly aligns with your business vision.

Why the Private Limited Company vs LLP Decision Is So Important

Choosing the wrong structure can lead to:

- Higher taxes than necessary

- Difficulty raising funds

- Compliance stress

- Forced conversion later

- Reduced credibility with investors

Understanding the Private Limited Company vs LLP comparison early helps founders avoid costly restructuring and legal friction.

Basic Overview: Private Limited Company vs LLP

| Aspect | Private Limited Company | LLP |

|---|---|---|

| Governing Law | Companies Act, 2013 | LLP Act, 2008 |

| Ownership | Shareholders | Partners |

| Management | Directors | Designated Partners |

| Legal Identity | Separate | Separate |

| Liability | Limited | Limited |

While both offer limited liability, their operational DNA is very different.

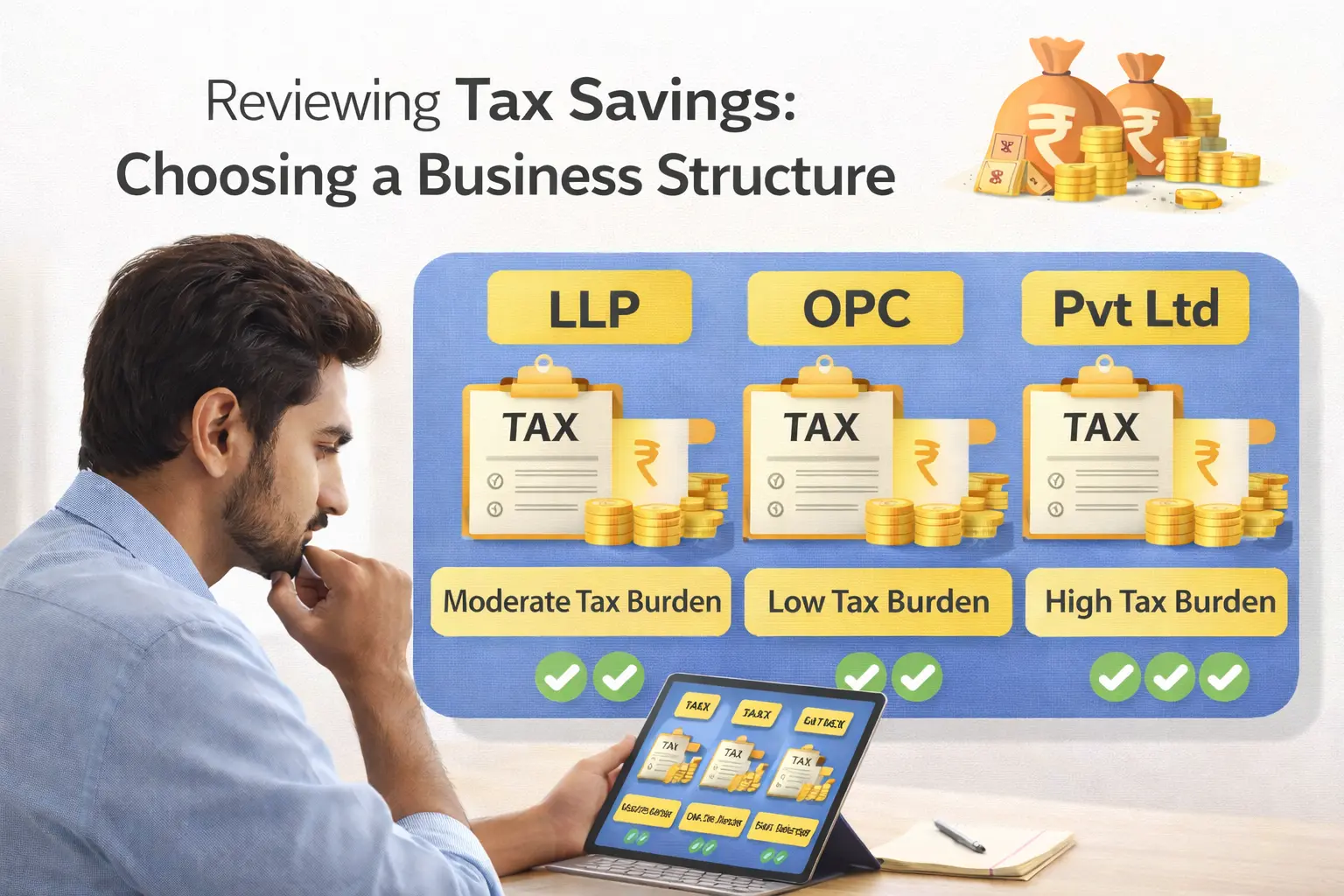

1. Taxation Difference: Private Limited Company vs LLP

Private Limited Company – Tax Structure

- Corporate tax (22% or 25% depending on conditions)

- Dividend taxed in shareholders’ hands

- Eligible for startup tax benefits (Section 80-IAC)

LLP – Tax Structure

- Flat 30% tax on profits

- No dividend distribution concept

- Limited tax planning flexibility

🔍 Key Insight:

If you plan to reinvest profits or scale, a Private Limited Company is more tax-efficient in the long run.

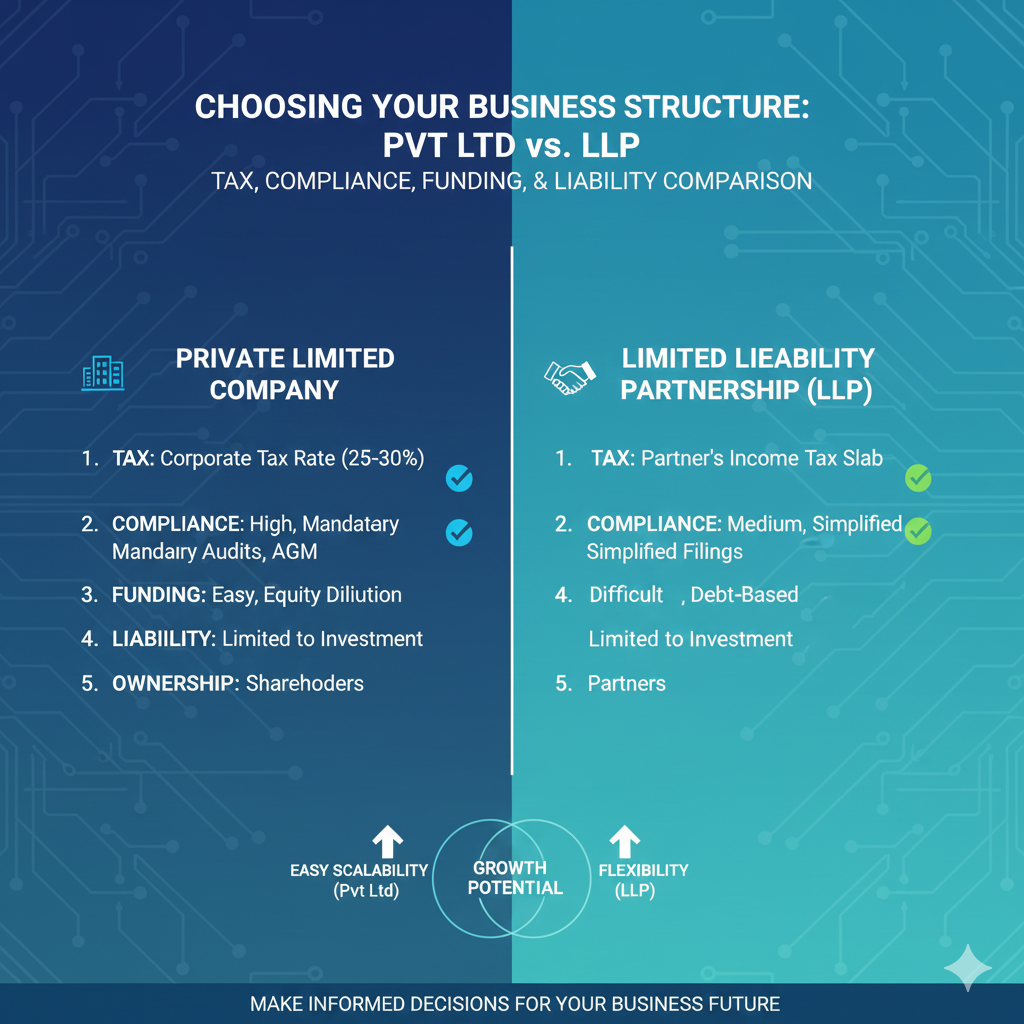

2. Private Limited Company vs LLP – Compliance Burden Comparison

| Compliance Area | Pvt Ltd | LLP |

|---|---|---|

| ROC Filings | Mandatory | Mandatory |

| Annual Return | Yes | Yes |

| Statutory Audit | Mandatory | Conditional |

| Board Meetings | Mandatory | Not required |

| Director KYC | Mandatory | Not applicable |

Reality Check:

- LLP has lower compliance

- Pvt Ltd has structured governance

👉 Lower compliance is easier early, but structured compliance builds credibility.

Read Previous Article on Startup Guides India.

3. Private Limited Company vs LLP – Fundraising & Investment Capability

This is where the difference becomes decisive.

Private Limited Company

- Can raise Angel & VC funding

- Can issue equity shares

- ESOPs allowed

- Preferred by investors

LLP

- Cannot issue equity shares

- Not suitable for VC/PE funding

- Mostly bootstrapped or partner-funded

👉 If funding is part of your future plan, LLP is not the right choice.

4. Private Limited Company vs LLP – Ownership Transfer & Exit

| Factor | Pvt Ltd | LLP |

|---|---|---|

| Ownership Transfer | Easy via shares | Complex |

| Exit Flexibility | High | Low |

| Due Diligence | Standard | Complicated |

Private Limited Companies are exit-friendly, making acquisitions and buyouts smoother.

5. Credibility & Market Perception

Banks, clients, and partners treat both structures differently.

Pvt Ltd is preferred for:

- Corporate contracts

- Government tenders

- Startup accelerators

- Enterprise clients

LLP is often seen as:

- Professional service firm

- Small or mid-scale operation

Perception directly affects growth velocity.

6. Scalability & Long-Term Growth

Choose Private Limited Company if you plan to:

- Scale nationally or globally

- Raise funds

- Hire aggressively

- Build long-term brand value

Choose LLP if you plan to:

- Run a stable service firm

- Operate with partners

- Avoid heavy compliance

7. Conversion Possibilities (LLP ↔ Pvt Ltd)

While conversion is possible:

- LLP → Pvt Ltd involves legal complexity

- Requires compliance history

- Time-consuming and costly

👉 Starting with the right structure saves future conversion pain.

Quick Comparison Table: Private Limited Company vs LLP

| Feature | Pvt Ltd | LLP |

|---|---|---|

| Limited Liability | Yes | Yes |

| Compliance Level | High | Medium |

| Fundraising | Excellent | Poor |

| Tax Flexibility | High | Limited |

| Exit Friendly | Yes | No |

| Best For | Startups | Service firms |

Which One Should You Choose? (Simple Rule)

- Choose Pvt Ltd → If growth, funding, or exit matters

- Choose LLP → If stability, low compliance, and services matter

There is no universally “better” option only a better fit

All structural and compliance rules are governed by the Ministry of Corporate Affairs

Conclusion: Structure Determines Speed

The debate of Private Limited Company vs LLP in India ultimately comes down to vision.

If you think small, LLP feels comfortable.

If you think big, Pvt Ltd scales better.

Your structure should not limit your ambition, it should support it.

FAQs

1. Is LLP better than Private Limited Company?

LLP is better for service-based firms; Private Limited is better for startups.

2. Can an LLP raise venture capital?

No. Investors prefer Private Limited Companies.

3. Which structure has lower compliance?

LLP has lower compliance than Private Limited

4. Can LLP be converted into Private Limited later?

Yes, but the process is complex and costly.

5. Which structure is better for long-term growth?

Private Limited Company.