Bootstrapped startups are built differently. There’s no external funding, no safety net, and no room for unnecessary costs. Every rupee matters. Every decision must support survival, control, and sustainable growth.

That’s why choosing the right business structure is one of the most important early decisions for bootstrapped founders in India.

A wrong business structure can quietly:

- Increase tax outflow

- Add compliance stress

- Limit flexibility

- Force expensive restructuring later

This article explains which business structure works best for bootstrapped startups in India, why some popular options fail, and how founders can choose wisely without over-engineering too early.

Why Business Structure Matters More for Bootstrapped Startups

Bootstrapped founders don’t have investor money to absorb mistakes.

Your business structure directly affects:

- Monthly and annual costs

- Tax efficiency

- Personal financial risk

- Ability to reinvest profits

- Ease of future transition

For bootstrapped startups, structure is not paperwork it’s financial strategy.

Common Business Structure Options for Bootstrapped Founders

Most bootstrapped founders evaluate one of these:

- Sole Proprietorship

- LLP (Limited Liability Partnership)

- OPC (One Person Company)

- Private Limited Company

Each has advantages, but not all are bootstrapping-friendly.

Why Sole Proprietorship Often Fails Bootstrapped Startups

Sole proprietorship looks attractive because:

- Zero setup complexity

- Minimal compliance

- Low initial cost

However, it comes with serious downsides:

- Unlimited personal liability

- Higher tax as income grows

- Low credibility with clients

- No separation between founder and business

For early validation, it may work, but it breaks quickly once revenue grows.

Is LLP a Good Business Structure for Bootstrapped Startups?

LLP is a popular choice among bootstrapped founders.

Why LLP Feels Attractive

- Separate legal entity

- Lower compliance than companies

- Better risk protection than proprietorship

Where LLP Falls Short

- Flat 30% tax rate

- Limited tax optimisation

- Weak scalability

- Poor suitability for future funding

LLP works best for stable service businesses, not product-driven startups planning growth.

Read Article on Startup Guides India.

OPC: A Smart Middle Path for Bootstrapped Founders

OPC is often overlooked, but for bootstrapped startups, it can be powerful.

Why OPC Works Well

- Separate legal identity

- Corporate tax rates

- Better expense planning

- No need for external partners initially

OPC Limitations

- Only one shareholder

- Mandatory conversion thresholds

- Not funding-friendly

OPC is ideal when:

- You are a solo founder

- You want tax efficiency

- You plan controlled growth before scale

Why Many Bootstrapped Startups Choose Private Limited Too Early

Private Limited Company offers:

- Maximum credibility

- Best long-term scalability

But for bootstrapped startups, it also brings:

- Higher compliance cost

- More governance overhead

- Less flexibility early on

Starting too early as Pvt Ltd can strain cash flow if revenue is still unstable.

So, What Is the Best Business Structure for Bootstrapped Startups?

There is no single answer, but there is a smart sequence.

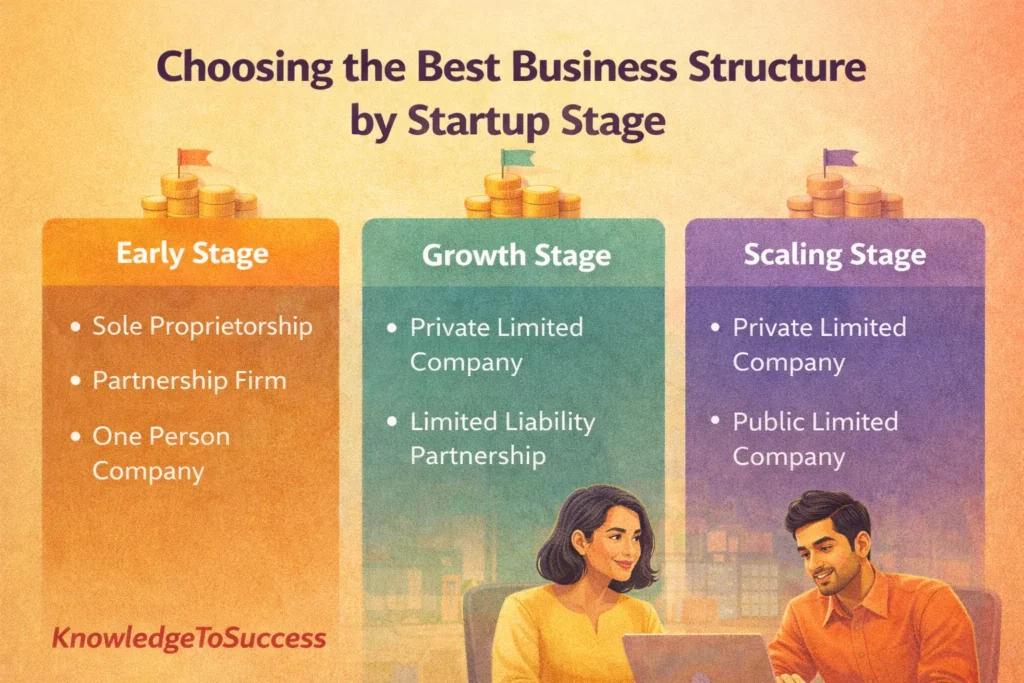

Stage-Wise Recommendation

| Startup Stage | Best Business Structure |

|---|---|

| Idea / Validation | Sole Proprietorship |

| Early Revenue | OPC |

| Stable Services | LLP |

| Scale / Funding Ready | Private Limited |

The best business structure is the one that fits your current stage without blocking your next stage.

Key Principles Bootstrapped Founders Should Follow

- Don’t over-register too early

- Don’t stay informal too long

- Optimise for cash flow first

- Plan conversion, not permanence

- Let structure evolve with growth

Bootstrapping rewards flexibility, not rigidity.

Common Business Structure Mistakes Bootstrapped Founders Make

- Choosing LLP only to avoid compliance

- Registering Pvt Ltd without revenue

- Ignoring tax impact until year end

- Mixing personal and business money

- Delaying structure change despite growth

Most of these mistakes cost more over time than compliance itself.

When Should a Bootstrapped Startup Change Its Business Structure?

You should reassess your business structure when:

- Profits increase consistently

- Tax outflow feels excessive

- Clients demand formal contracts

- Hiring or partnerships begin

- Funding conversations start

Structure should support growth — not resist it.

Final Verdict: Structure for Control, Not Just Convenience

For bootstrapped startups in India, the best business structure is not the most impressive one, it’’’s the most practical one.

- Start simple

- Protect yourself legally

- Optimise tax gradually

- Convert when growth demands it

A smart business structure allows bootstrapped founders to stay lean today and scale smoothly tomorrow.

FAQs

1. Is LLP best for bootstrapped startups?

Only for stable service businesses.

2. Is OPC better than Pvt Ltd for bootstrapped founders?

Yes, in early stages.

3. Can bootstrapped startups convert later?

Yes, conversion is common and recommended.

4. Does business structure affect tax heavily?

Yes, especially as profits grow.

5. Should bootstrapped startups plan for funding early?

Yes, structure should not block future options.