Many startup founders hear the term ROC compliance but don’t fully understand what it means.

They know it’s “something related to filings.”

They know missing it causes penalties.

But they don’t know what exactly needs to be done or when.

The truth is simple:

Ignoring Registrar of Companies (ROC) compliance is one of the fastest ways to damage your startup’s credibility.

This article explains Registrar of Companies (ROC) compliance in plain English, covering what it is, why it matters, what you must file, and what happens if you ignore it.

What Is ROC Compliance?

ROC stands for Registrar of Companies.

It operates under the Ministry of Corporate Affairs (MCA) in India.

Registrar of Companies compliance refers to the mandatory filings and legal requirements that companies must complete every year to remain legally active.

If you run a:

- Private Limited Company

- One Person Company (OPC)

- LLP

…you must follow ROC(Registrar of Companies) compliance rules.

It is not optional.

Why ROC Compliance Matters for Startup Founders

Many founders focus on product and growth, but compliance builds:

- Investor trust

- Legal protection

- Funding readiness

- Exit readiness

- Corporate credibility

During due diligence, investors always check your ROC (Registrar of Companies) compliance history.

Missed filings = red flag.

Basic ROC Compliance Requirements for Private Limited Companies

Here’s what most startups must file annually:

1️⃣ Financial Statements (AOC-4)

Includes:

- Balance Sheet

- Profit & Loss Statement

- Auditor’s Report

Filed after Annual General Meeting (AGM).

2️⃣ Annual Return (MGT-7)

Contains:

- Shareholding details

- Director information

- Company structure

Filed within 60 days of AGM.

3️⃣ DIR-3 KYC (Director KYC)

All directors must complete annual KYC verification.

4️⃣ Board Meetings

Minimum:

- 4 board meetings per year

- Gap not exceeding 120 days

Board resolutions must be recorded properly.

Read Previous Article on Startup Guides India.

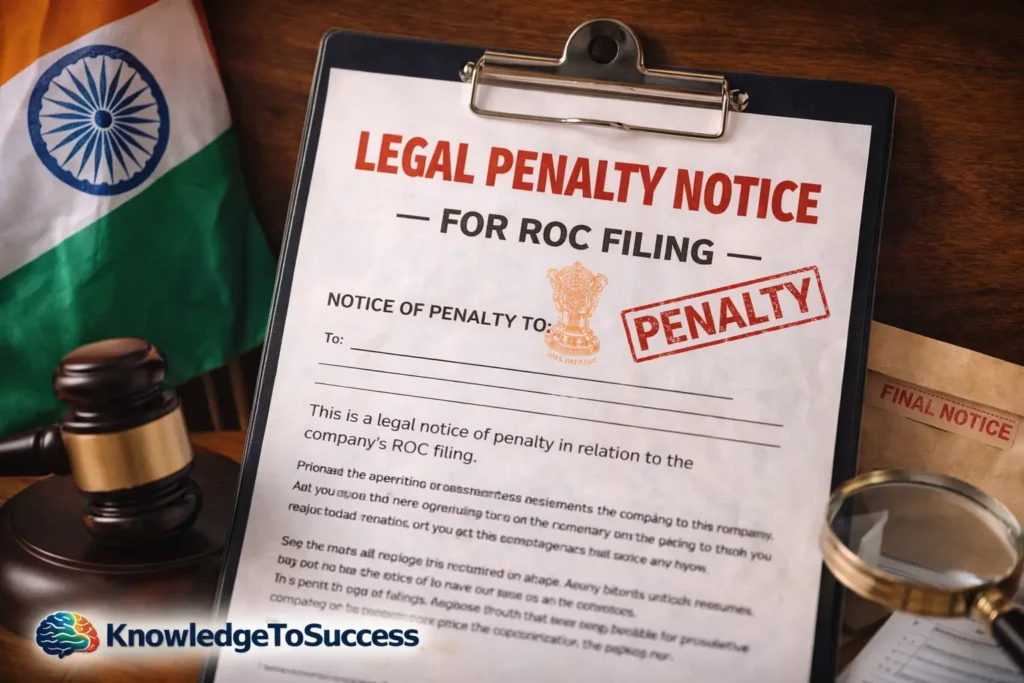

What Happens If You Ignore ROC Compliance?

Ignoring ROC compliance can lead to:

- Heavy monetary penalties

- Additional fees per day of delay

- Director disqualification

- Company marked as inactive

- Difficulty raising funding

Penalties accumulate quickly, often daily.

Non-compliance also damages valuation and investor confidence.

Common ROC Compliance Mistakes Startups Make

- Missing filing deadlines

- Delaying AGM

- Ignoring DIR-3 KYC

- Poor record-keeping

- Not appointing auditor properly

Most of these are avoidable with planning.

ROC Compliance vs Income Tax – Are They Different?

Yes. Many founders confuse Registrar of Companies (ROC) compliance with tax filing.

| ROC Compliance | Income Tax Filing |

|---|---|

| Governed by MCA | Governed by Income Tax Dept |

| Focus on company structure | Focus on tax calculation |

| Annual return + financials | Income tax return |

You must do both.

How ROC Compliance Impacts Funding

Investors check:

- Filing consistency

- Penalty history

- Active company status

- Director compliance

If your ROC compliance is weak:

- Funding slows

- Valuation drops

- Trust reduces

Clean compliance = faster deals.

How to Stay on Top of ROC Compliance

- Maintain compliance calendar

- Hire CA/CS professional

- Track deadlines quarterly

- Keep digital document archive

- Conduct regular board meetings

Proactive compliance costs less than reactive penalties.

When Does ROC Compliance Start?

Immediately after incorporation.

Even if:

- Revenue is zero

- Business is inactive

- Startup is in development phase

Compliance is still mandatory.

ROC Compliance for LLPs

If you run an LLP, you must file:

- Form 8 (Statement of Accounts)

- Form 11 (Annual Return)

While simpler than companies, LLP Registrar of Companies (ROC) compliance is still mandatory.

Final Verdict: Compliance Is a Growth Asset

ROC compliance may seem like a legal burden.

But in reality, it:

- Protects founders

- Signals discipline

- Strengthens valuation

- Enables smooth exits

Startups that treat compliance seriously grow with fewer disruptions.

Ignoring Registrar of Companies (ROC) compliance is not saving money, it’s delaying a bigger problem.

FAQs

1. Is ROC compliance mandatory every year?

Yes, even if revenue is zero.

2. Can a startup skip ROC filing in early stages?

No.

3. What is the penalty for late ROC filing?

Additional fees per day and possible director disqualification.

4. Do LLPs also have ROC compliance?

Yes, though requirements differ.

5. Does ROC compliance affect funding?

Yes, investors check compliance history.