Most startup founders don’t ignore ROC filings intentionally.

They delay them.

They assume a few days won’t matter.

They assume penalties will be minor.

But missing ROC filings in India can trigger serious financial and legal consequences, sometimes far beyond what founders expect.

This article explains, in simple language:

- What ROC filings are

- What happens if you miss them

- How penalties are calculated

- Whether directors can be disqualified

- How to fix delayed filings

No legal jargon. Just clarity.

What Are ROC Filings? (Quick Refresher)

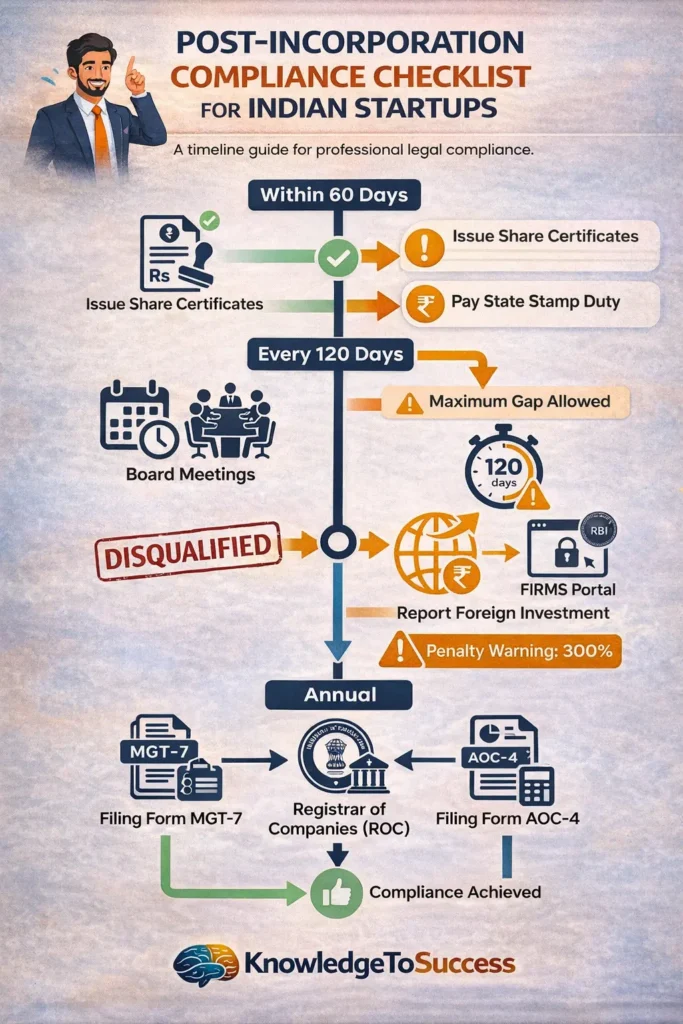

ROC filings are mandatory annual or event-based submissions made to the Registrar of Companies under the Ministry of Corporate Affairs (MCA).

For Private Limited Companies, common ROC filing include:

- AOC-4 (Financial Statements)

- MGT-7 (Annual Return)

- DIR-3 KYC (Director KYC)

These filings keep your company legally active and compliant.

What Happens Immediately After You Miss ROC Filings?

The first consequence is late fees.

Late fees are not fixed, they accumulate per day of delay.

This means:

- 10 days late = 10 days penalty

- 100 days late = 100 days penalty

Even small delays become expensive quickly.

ROC Filings Late Filing Fees: How They Work

For most ROC filing:

- ₹100 per day of delay (minimum)

- No upper limit in many cases

Example:

If you delay a filing by 120 days:

₹100 × 120 = ₹12,000

This is per form.

If multiple forms are delayed, penalties multiply.

Additional Consequences of Missing ROC Filings

Heavy Financial Penalties

Apart from daily late fees, additional penalties may apply depending on the nature of default.

Director Disqualification**

If a company fails to file financial statements or annual returns for three consecutive financial years, directors can be disqualified for five years.

That means:

- Cannot become director in any company

- DIN (Director Identification Number) may be deactivated

- Professional credibility suffers

This is one of the most serious outcomes.

Company Marked as Inactive or Struck Off

Persistent non-compliance can lead to:

- Company status marked as “Inactive”

- Removal from MCA records

- Difficulty reopening operations

Reactivation involves legal procedures and additional cost.

Funding and Valuation Impact

Investors check ROC filing history during due diligence.

If they see:

- Repeated delays

- Accumulated penalties

- Director non-compliance

They may:

- Reduce valuation

- Delay funding

- Walk away entirely

Compliance history directly affects credibility.

Read Previous Article on Startup Guides India

Can You Fix Missed ROC Filings?

Yes.

Delayed ROC filing can still be submitted with additional fees.

Steps usually include:

- Preparing pending financial statements

- Conducting overdue AGM (if required)

- Filing forms with late fee

- Paying accumulated penalties

However, the longer you wait, the costlier it becomes.

Common Founder Mistakes Around ROC Filings

- Waiting until funding discussions begin

- Ignoring DIR-3 KYC

- Assuming CA will “handle it automatically”

- Not maintaining compliance calendar

Compliance is founder responsibility, not just accountant responsibility.

How to Avoid Missing ROC Filings

- Maintain annual compliance calendar

- Track MCA deadlines quarterly

- Hire CA/CS professional

- Conduct timely board meetings

- Never ignore MCA emails or notices

Prevention is cheaper than penalties.

ROC Filings vs Income Tax: Don‘t Confuse Them

ROC filing:

- Governed by MCA

- Focus on company structure and reporting

Income tax filing:

- Governed by Income Tax Department

- Focus on tax payment

Both are mandatory. One does not replace the other.

Real-World Scenario

A startup misses AOC-4 and MGT-7 for 2 years.

They raise funding in year 3.

During due diligence:

- Investors discover delays

- Directors face disqualification risk

- Deal terms change

A small delay becomes a strategic setback.

Final Verdict: Missing ROC Filings Is Expensive, Not Optional

ROC filing may feel like routine paperwork.

But missing them can lead to:

- Daily penalties

- Director bans

- Funding delays

- Reputational damage

For startups, compliance is not just legal, it’s strategic.

Clean ROC filing signal discipline, governance, and long-term credibility.

FAQs

1. What is the penalty for late ROC filing?

Typically ₹100 per day of delay per form.

2. Can directors be banned?

Yes, after three consecutive years of non-filing.

3. Can late ROC filings be corrected?

Yes, with additional fees.

4. Is ROC filings mandatory even with no revenue?

Yes.

5. Does missing ROC filings affect funding?

Yes, investors check compliance history.