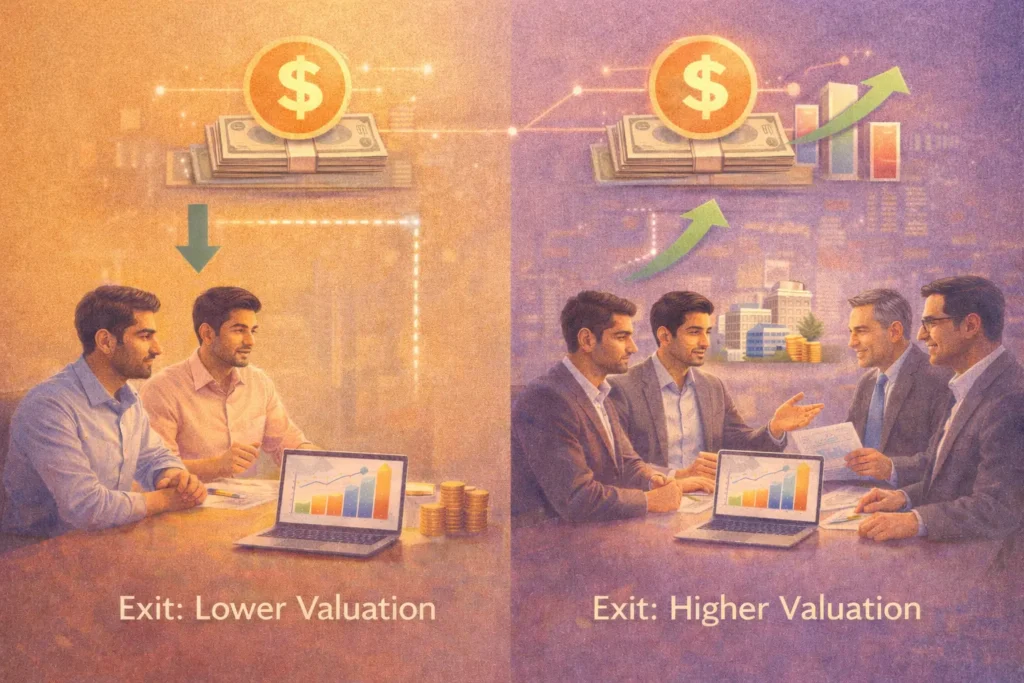

Many founders believe valuation depends only on revenue, growth, and traction. That’s only half the truth. In reality, business structure plays a silent but decisive role in valuation and exit opportunities. Two startups with identical numbers can receive very different valuations, simply because one is structured better.

This article explains how business structure impacts valuation, why investors and acquirers care so deeply about it, and how the wrong structure can quietly destroy exit opportunities even when the business performs well.

Why Business Structure Matters in Valuation Discussions

Valuation is not just about numbers.

It is about risk, clarity, and future flexibility.

Your business structure directly affects:

- Ownership clarity

- Investor rights

- Tax efficiency at exit

- Ease of acquisition or merger

- Legal risk exposure

When structure is weak, valuation is discounted, no matter how good the business looks on paper.

How Investors and Acquirers Actually Look at Valuation

During due diligence, buyers and investors ask:

- Who owns what?

- Can shares be transferred easily?

- Are there legal or compliance risks?

- Is the structure scalable?

- Will exit be clean or messy?

If the structure raises doubts, valuation drops immediately or the deal collapses.

Business Structures and Their Impact on Valuation

Let’s look at how common structures behave at exit.

Sole Proprietorship

- No separate legal entity

- No share transfer mechanism

- Exit possible only via asset sale

👉 Valuation is usually low and limited.

LLP (Limited Liability Partnership)

- Separate entity, but partnership-based

- Equity-style exits are complex

- Many acquirers avoid LLPs

👉 Valuation often faces discounts or delays.

OPC (One Person Company)

- Corporate structure

- Cleaner ownership

- Still limited for funding and exits

👉 Better than LLP, but not ideal for high-value exits.

Private Limited Company

- Clear shareholding

- Easy equity transfer

- Investor-friendly

- M&A-ready

👉 Highest valuation potential and cleanest exits.

Read Previous Article on Startup Guides India.

Why Business Structure Directly Affects Exit Opportunities

Exit opportunities depend on how easily ownership can change hands.

A strong structure:

- Allows share sale instead of asset sale

- Reduces legal friction

- Makes buyer integration easier

- Protects founders from personal liability

Weak structure forces buyers to:

- Re-negotiate terms

- Demand valuation cuts

- Walk away entirely

Common Business Structure Issues That Reduce Valuation

1. Business Structure – Messy Cap Table

- Too many early shareholders

- No vesting clauses

- Friends/family equity without roles

This scares acquirers.

2. Business Structure– Wrong Legal Entity

- LLP or proprietorship when scale is achieved

- Forced conversion during exit talks

This delays deals and weakens leverage.

3. Business Structure – Compliance Gaps

- Missed filings

- Poor governance

- Informal agreements

Compliance risk always reduces valuation.

4. Business Structure – No ESOP Framework

- Weak talent retention

- Unclear incentive alignment

Buyers value teams, not just products.

Valuation Discount: The Hidden Cost of Poor Business Structure

Founders often ask:

“Can’t we just fix the structure during exit?”

Technically yes.

Practically, that’s when valuation takes a hit.

Why?

- Buyers sense urgency

- Founders lose negotiating power

- Legal timelines delay closure

Good exits reward early structure discipline, not last-minute fixes.

How Business Structure Impacts Different Exit Types

| Exit Type | Structure Impact |

|---|---|

| Acquisition | Clean structure = faster close |

| Merger | Compatible structure = better terms |

| Strategic Sale | Clear cap table = higher value |

| Secondary Sale | Pvt Ltd preferred |

| IPO | Only corporate structures qualify |

In almost every scenario, Private Limited Companies perform best.

When Should Founders Fix Their Business Structure?

The best time is before:

- Funding conversations

- Strategic partnerships

- M&A discussions

If you wait until exits appear, you are already late.

How to Align Business Structure With Exit Goals

- Choose a structure that supports equity transfer

- Keep cap table simple

- Stay compliant consistently

- Plan ESOPs early

- Convert before scale, not after

Structure should enable exits, not block them.

Real-World Founder Insight

Many startups don’t fail to exit because they lack buyers.

They fail because buyers don’t want the legal complexity.

Business structure decides whether:

- You negotiate from strength

- Or accept discounted offers

Final Verdict: Valuation Is Earned, Exits Are Enabled

Growth creates interest. But it decides outcomes.

If you want:

- Higher valuation

- Faster exits

- Cleaner deals

- Stronger negotiation power

…your business structure must be designed for exits long before exits appear.

Structure is not paperwork. It’s your valuation multiplier.

FAQs

1. Does business structure really affect valuation?

Yes. It directly impacts risk and deal complexity.

2. Can LLPs get good exit valuations?

Rarely, unless converted early.

3. Is Private Limited best for exits?

Yes, it offers maximum flexibility.

4. When should founders restructure?

Before funding or acquisition talks.

5. Does compliance affect valuation?

Absolutely. Poor compliance reduces trust and value.