Registering a Private Limited Company is a big achievement. However, many founders unknowingly step into legal trouble after incorporation, not before it. This article highlights the most common legal and compliance mistakes in Private Limited Companies, explains why they happen, and shows how founders can stay on the right side of the law.

In India, most penalties, notices, and director disqualifications happen because of post-registration non-compliance, not business failure. What makes it worse is that many of these issues are completely avoidable.

Why Compliance Mistakes Are More Dangerous Than They Look

Compliance failures don’t always cause immediate problems. In fact, many founders continue operating for months without realizing something is wrong until a notice arrives.

Common consequences include:

- Heavy monetary penalties

- Director DIN deactivation

- ROC notices

- Loss of investor trust

- Company strike-off

Understanding legal and compliance mistakes in a Private Limited Company is critical for long-term survival.

Legal and Compliance Mistakes #1: Missing INC-20A (Commencement of Business)

INC-20A must be filed within 180 days of incorporation.

Why founders miss it:

- Assuming registration is complete

- No immediate reminder from MCA

- Share capital not deposited on time

Consequences:

- Company cannot legally operate

- Heavy penalties

- Risk of company strike-off

👉 This is one of the most serious compliance mistakes new companies make.

Legal and Compliance Mistakes #2: Not Appointing an Auditor on Time

Every Private Limited Company must appoint its first statutory auditor within 30 days.

Common reasons:

- Assuming audit starts only after revenue

- Delaying professional engagement

Why this matters:

- Auditor appointment is mandatory even for zero-revenue companies

- Non-appointment is a legal violation

This mistake often triggers early ROC scrutiny.

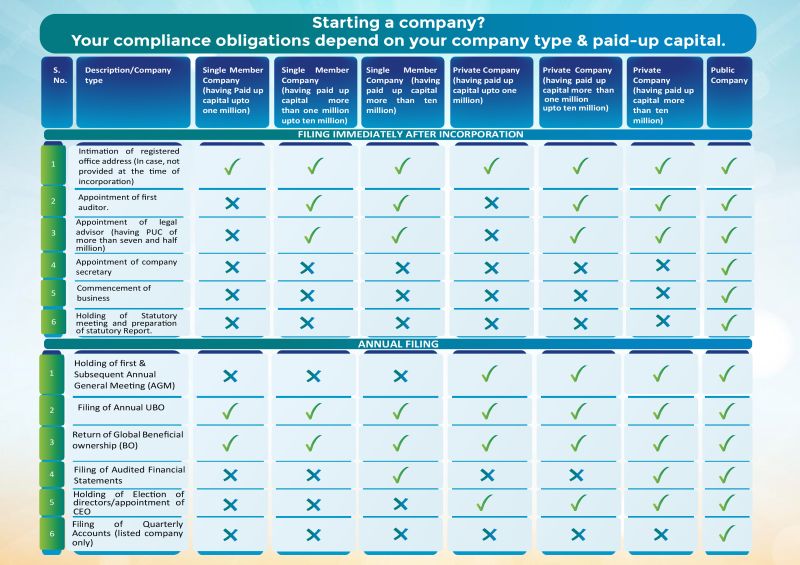

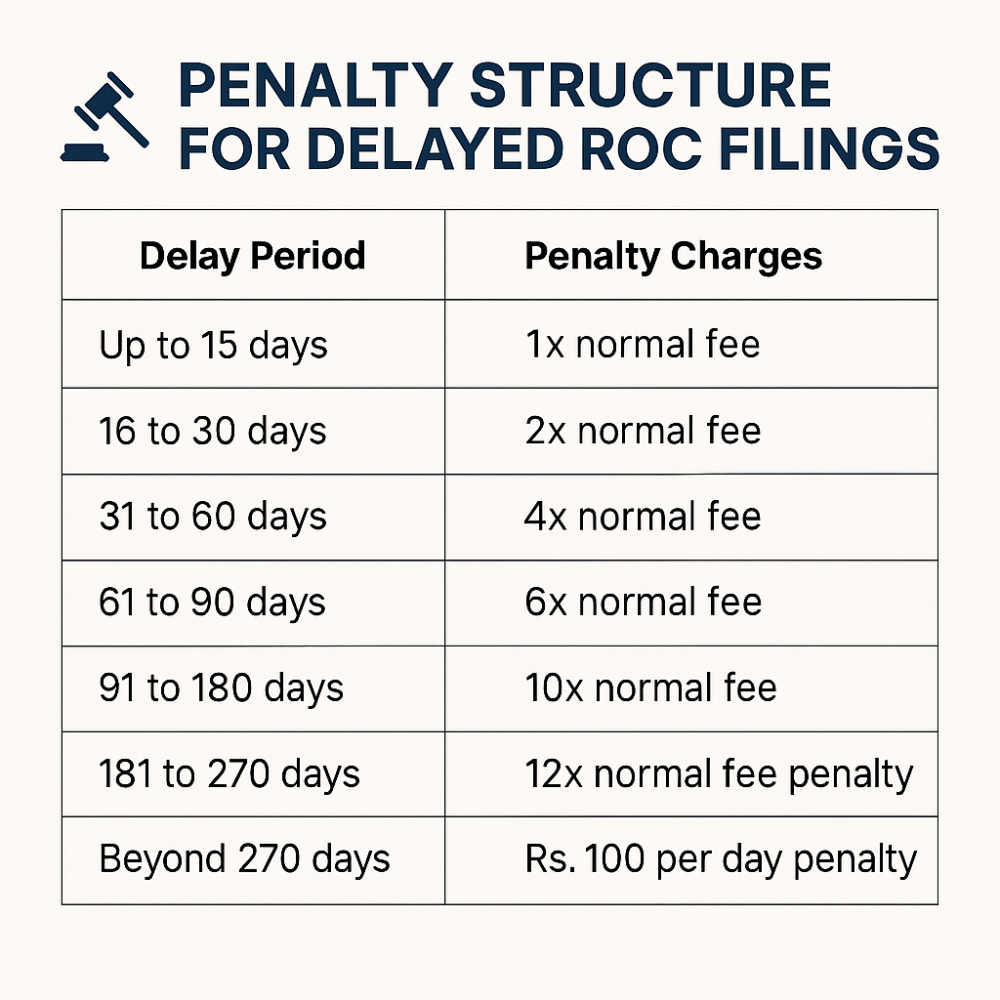

Legal and Compliance Mistakes #3: Ignoring Annual ROC Filings

Even if the company has:

- No revenue

- No transactions

- No employees

👉 Annual ROC filings are mandatory.

Missed filings lead to:

- ₹100 per day late fees

- Director disqualification

- Company marked as non-compliant

This is among the most common Legal and Compliance Mistakes in Private Limited Companies.

Read Previous Article on Startup Guides India.

Legal and Compliance Mistakes #4: Poor Maintenance of Statutory Registers

Companies are required to maintain:

- Register of members

- Register of directors

- Minutes books

- Shareholding records

What founders do wrong:

- Rely only on digital filings

- Don’t update registers after changes

- Ignore documentation completely

In inspections or due diligence, this becomes a major red flag.

Legal and Compliance Mistakes #5: Director KYC & DIN Non-Compliance

Every director must complete DIR-3 KYC annually.

If missed:

- DIN gets deactivated

- ₹5,000 penalty per director

- Director cannot sign filings

This small oversight can freeze all company filings.

Legal and Compliance Mistakes #6: Delayed or Incorrect Share Issuance

After incorporation:

- Share capital must be deposited

- Share certificates must be issued within 60 days

Common issues:

- No proof of capital deposit

- Share certificates not issued

- Wrong shareholding records

These mistakes cause legal trouble during:

- Fundraising

- Due diligence

- Exit or acquisition

Legal and Compliance Mistakes #7: Mixing Personal & Company Finances

This is a silent but serious compliance risk.

Common practices:

- Using company account for personal expenses

- Not maintaining vouchers

- No clear expense segregation

Why this is risky:

- Violates corporate governance

- Raises tax scrutiny

- Weakens legal separation

This mistake defeats the purpose of limited liability.

Legal and Compliance Mistakes #8: Ignoring Event-Based ROC Filings

Certain changes require mandatory ROC filings, such as:

- Director appointment/resignation

- Registered office change

- Share capital increase

- Share transfers

Ignoring event-based compliance is one of the most overlooked legal mistakes.

Legal and Compliance Mistakes #9: Delaying Tax & GST Compliance

While MCA compliance is critical, tax compliance is equally important.

Common errors:

- Delayed income tax returns

- Wrong GST classification

- Missing TDS filings

This leads to:

- Penalties

- Interest

- Department notices

Legal and Compliance Mistakes #10: No Compliance Calendar or Professional Support

Many startups operate without:

- Compliance calendar

- Dedicated CA/CS

- Reminder systems

As a result, deadlines are missed unintentionally.

👉 Compliance is not optional it is a system that must be managed.

Quick Checklist: Legal and Compliance Mistakes to Avoid

| Area | Common Mistake |

|---|---|

| MCA | Missing INC-20A |

| Audit | No auditor appointment |

| ROC | Skipping annual filings |

| Directors | Missing DIR-3 KYC |

| Shares | No certificates issued |

| Finance | Mixing personal & business funds |

| Events | Ignoring event-based filings |

All legal requirements are governed by the Ministry of Corporate Affairs

Conclusion: Compliance Discipline Is a Founder Skill

Most Private Limited Companies don’t fail because of bad ideas—they struggle because of avoidable compliance mistakes.

When founders treat compliance as:

- A system

- A routine

- A responsibility

…the business becomes stronger, cleaner, and investor-ready.

Avoiding these legal and compliance mistakes in Private Limited Companies protects not just the business but also the directors behind it.

FAQs

1. What is the biggest compliance mistake in Pvt Ltd companies?

Missing INC-20A and annual ROC filings.

2. Can directors be disqualified for non-compliance?

Yes, repeated defaults can lead to disqualification.

3. Is compliance required even if there is no business activity?

Yes, annual filings are mandatory regardless of activity.

4. Can penalties be waived later?

Rarely. Most penalties are statutory and unavoidable.

5. Should startups outsource compliance?

Yes, it reduces risk and ensures deadlines are met.