Starting a business is exciting, but one of the first questions every founder asks is simple and practical: how much does it actually Cost for Private Limited Company Registration in India?

While many websites promise “cheap” or “₹999 registrations,” the reality is more nuanced. The cost of Private Limited Company Registration depends on several factors such as government fees, professional charges, capital structure, and post-incorporation compliance.

This article gives you a transparent, end-to-end cost breakdown, so you can budget correctly, avoid surprises, and make informed decisions as a founder.

Why Understanding Cost of Private Limited Company Registration Matters for Founders

Many entrepreneurs underestimate incorporation costs and later face issues like:

- Unexpected professional fees

- Delays due to unpaid government charges

- Missed post-registration filings

- Cash flow stress in the first month

Understanding the Cost of Private Limited Company Registration upfront helps you:

- Plan startup capital better

- Choose the right service provider

- Avoid hidden or recurring charges

- Stay legally compliant from day one

Key Components That Decide the Registration Cost

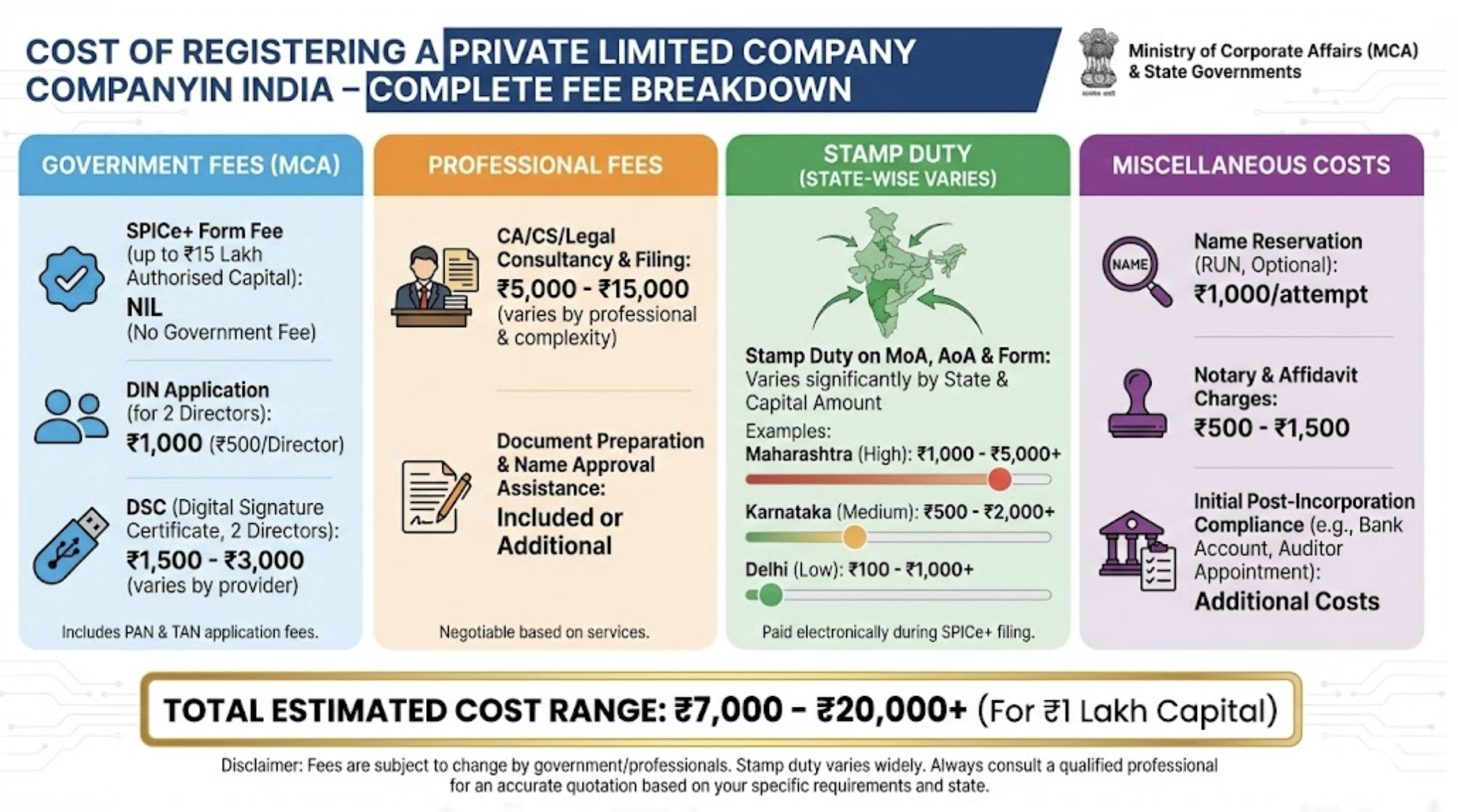

The total cost of registering a Private Limited Company in India is broadly divided into four parts:

- Government fees

- Digital Signature Certificate (DSC) cost

- Professional or consultant fees

- Post-incorporation compliance costs

Let’s examine each component in detail.

1. Government Fees for Private Limited Company Registration

Government fees are paid to the Ministry of Corporate Affairs (MCA) during incorporation.

A. Name Approval Fees

- Included in SPICe+ form

- No separate fee if applied correctly

- Additional resubmission may add delay but no extra charge

B. SPICe+ Incorporation Fees

Government fees depend on authorised share capital.

| Authorised Capital | Government Fee |

|---|---|

| Up to ₹1,00,000 | ₹0 |

| ₹1–5 lakhs | ₹0 |

| Above ₹5 lakhs | Increases as per slab |

👉 For most startups, government fees are minimal or zero.

2. Digital Signature Certificate (DSC) Cost

DSC is mandatory since all filings are online.

Typical DSC cost:

- ₹1,000 – ₹1,500 per director

- Valid for 2 years

Total DSC cost:

- 2 directors × ₹1,200 (average) = ₹2,400

DSC cost is a fixed and unavoidable expense in the cost of registering a Private Limited Company.

3. Director Identification Number (DIN) Charges

Good news for founders:

- DIN is free when applied through SPICe+

- No separate payment required

DIN remains valid for a lifetime.

4. Professional Fees (CA / CS / Consultant Charges)

This is where costs vary the most.

Typical professional fee range:

- ₹5,000 – ₹15,000

Professional fees usually include:

- Name approval

- SPICe+ filing

- MOA & AOA drafting

- PAN & TAN application

- Basic incorporation support

👉 Extremely low prices often exclude important services.

Read Previous Article on Startup Guides India

5. Cost of MOA & AOA (Digital Format)

MOA and AOA are now filed electronically.

Cost impact:

- Included in professional fees

- Stamp duty varies by state

- Average stamp duty: ₹500 – ₹2,000

This cost depends on the state of registered office.

6. Registered Office Setup Cost (If Applicable)

If you already have an address:

- No extra cost

If renting:

- Rent agreement

- NOC from owner

- Minor documentation cost

This is not a direct MCA cost, but still affects your overall registration budget.

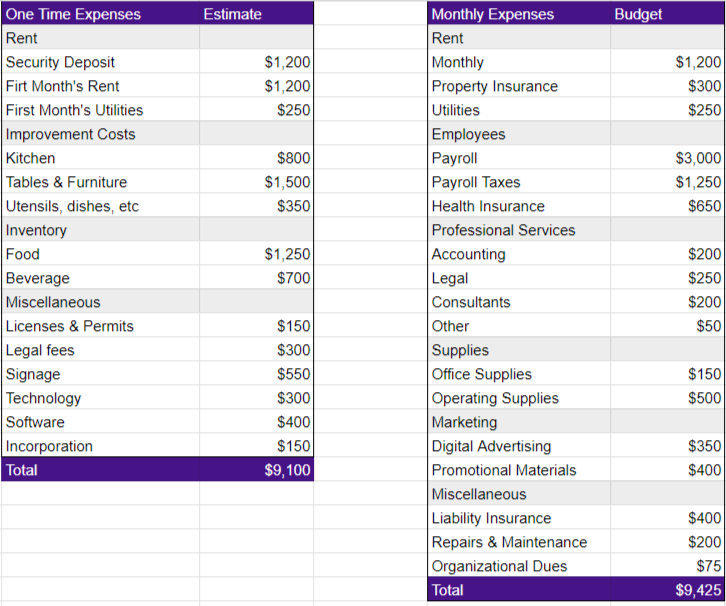

7. Post-Incorporation Compliance Costs (Often Ignored)

Many founders think registration is the final expense. It is not.

Mandatory post-registration costs:

- Auditor appointment: ₹2,000 – ₹5,000

- INC-20A filing: ₹1,000 – ₹2,000

- Bank account setup: Mostly free

- Statutory registers & records

Ignoring these can result in penalties.

8. Optional Costs (Depending on Business Needs)

These are not mandatory but commonly required:

| Service | Approx Cost |

|---|---|

| GST Registration | ₹1,000 – ₹3,000 |

| MSME (Udyam) | Free |

| Trademark filing | ₹4,500 – ₹9,000 |

| Current account opening | Usually free |

These costs are separate from incorporation, but founders should plan for them.

Total Cost Summary: Realistic Estimate

| Cost Component | Approx Amount (₹) |

|---|---|

| Government fees | 0 – 2,000 |

| DSC (2 directors) | 2,000 – 3,000 |

| Professional fees | 5,000 – 15,000 |

| Stamp duty | 500 – 2,000 |

| Post-incorporation | 3,000 – 7,000 |

Total Estimated Cost:

👉 ₹10,000 to ₹25,000 (realistic and honest range)

This is the true cost of registering a Private Limited Company in India for most startups.

Common Cost-Related Mistakes Founders Make

❌ Believing “₹999 Company Registration” ads

❌ Ignoring post-incorporation costs

❌ Choosing service providers only on price

❌ Not budgeting for DSC renewal

❌ Missing compliance deadlines leading to penalties

A slightly higher upfront cost often saves much more later.

How to Reduce Private Limited Company Registration Legally

Founders can control costs by:

- Keeping authorised capital minimal initially

- Having documents ready in advance

- Avoiding repeated name rejections

- Choosing transparent professionals

Cost reduction should never compromise legal correctness.

Conclusion: Private Limited Company Registration – Budget Smart, Register Right

The cost of registering a Private Limited Company is not expensive but it must be understood clearly.

When you plan correctly:

- There are no surprises

- Compliance stays smooth

- Cash flow remains stable

- Growth begins on a strong legal base

For serious founders, company registration is not an expense it’s an investment in credibility, protection, and scalability.

Private Limited Company Registration – FAQs

1. What is the minimum cost to rPrivate Limited Company Registration in India?

The practical minimum cost ranges between ₹10,000 and ₹15,000.

2. Are government fees mandatory?

Yes, but for low capital companies, government fees are minimal or zero.

3. Is professional help compulsory?

Legally no, but practically yes to avoid errors and delays.

4. Does Private Limited Company Registration cost include GST or trademark?

No, these are separate registrations.

5. Can Private Limited Company Registration cost vary by state?

Yes, mainly due to stamp duty differences.