📊 Old Tax Regime vs. New Tax Regime – Detailed Comparison

1. Introduction

Since FY 2020–21 (AY 2021–22), Indian taxpayers have been given the option to choose between:

- Old Tax Regime → Higher tax rates but with many exemptions and deductions.

- New Tax Regime → Lower tax rates but with minimal exemptions/deductions.

This flexibility means you must compare both systems each year to decide which one saves you more tax.

2. Tax Slab Rates

🟢 New Tax Regime (as per Budget 2023–24, effective AY 2024–25)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

✅ Standard Deduction of ₹50,000 is now allowed in the new regime.

✅ Rebate under Section 87A → Income up to ₹7 lakh = Zero tax.

🔵 Old Tax Regime

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5% |

| 5,00,001 – 10,00,000 | 20% |

| Above 10,00,000 | 30% |

✅ Rebate under Section 87A → Income up to ₹5 lakh = Zero tax.

✅ Multiple exemptions & deductions available.

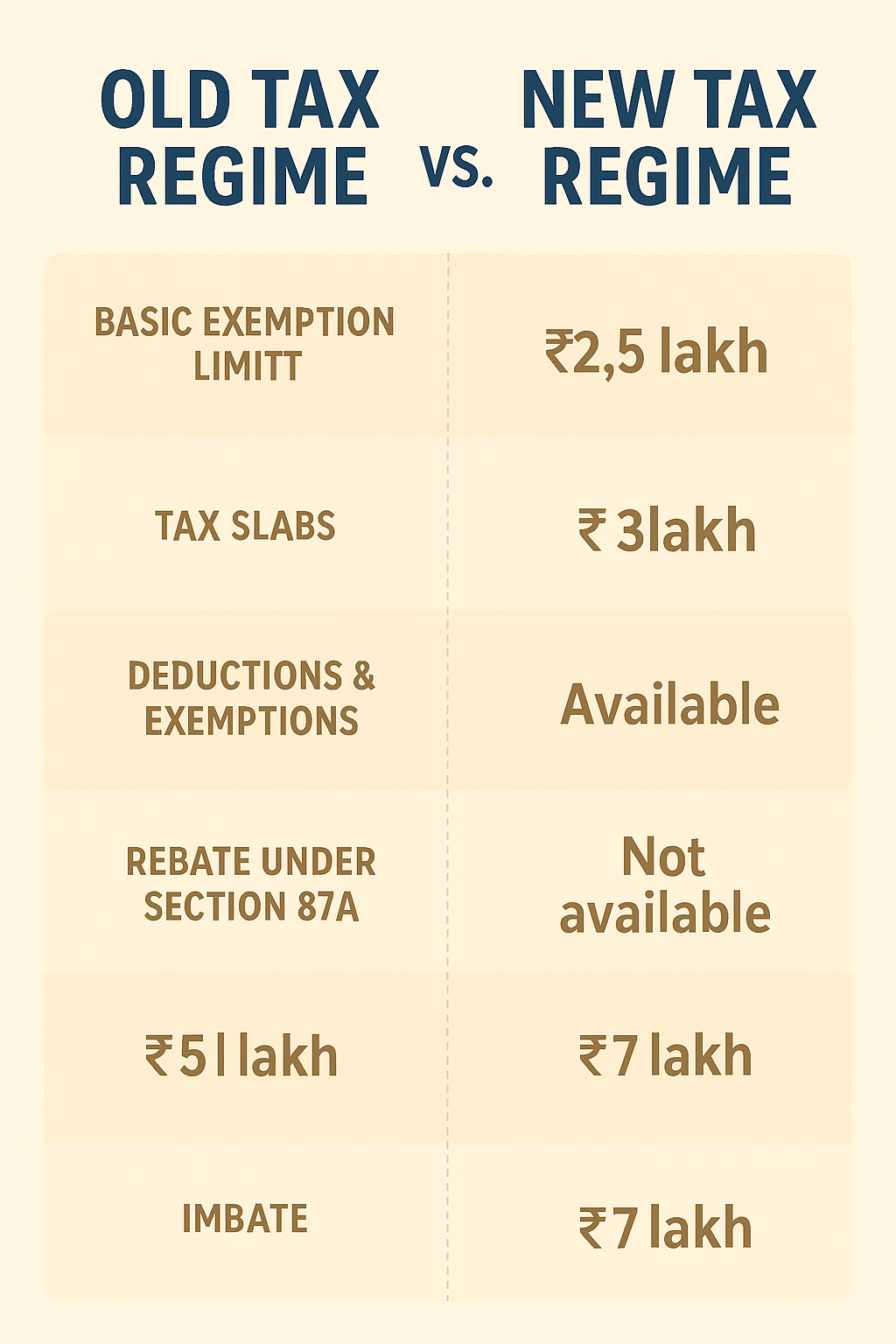

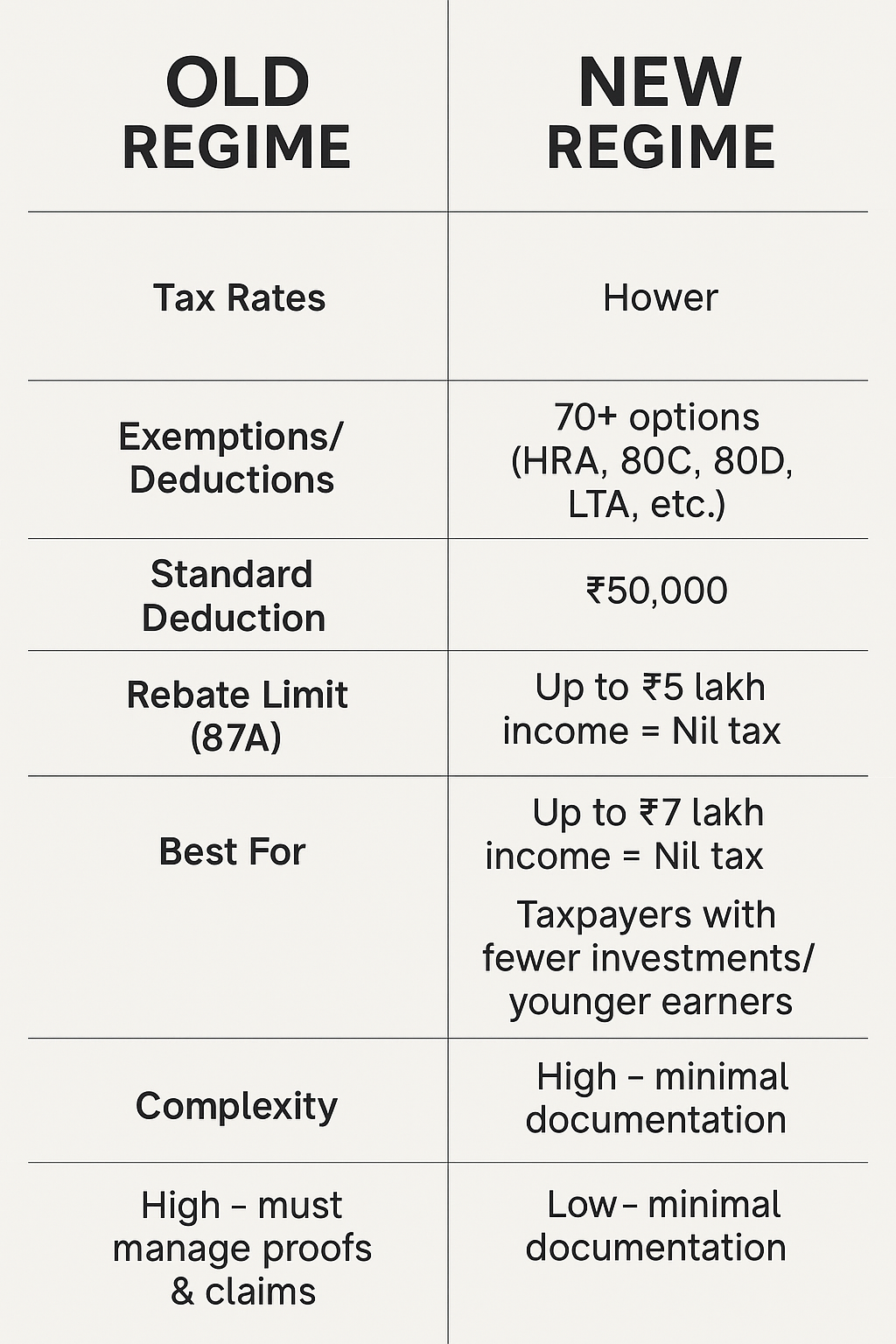

3. Key Differences

| Feature / Aspect | Old Regime | New Regime |

|---|---|---|

| Tax Rates | Higher | Lower |

| Exemptions/Deductions | 70+ options (HRA, 80C, 80D, LTA, etc.) | Very limited (Std. Deduction, NPS 80CCD(2)) |

| Standard Deduction | ₹50,000 | ₹50,000 (since 2023) |

| Rebate Limit (87A) | Up to ₹5 lakh income = Nil tax | Up to ₹7 lakh income = Nil tax |

| Best For | Taxpayers with high investments & rent | Taxpayers with fewer investments/younger earners |

| Flexibility | Allows restructuring salary to save tax | Simpler, less paperwork |

| Complexity | High – must manage proofs & claims | Low – minimal documentation |

4. Who Should Choose Which?

- Old Regime is better for you if:

✅ You claim high deductions like:- 80C (PF, ELSS, LIC, PPF) → up to ₹1.5 lakh

- 80D (Health Insurance) → ₹25k–₹1 lakh

- HRA, LTA, Home Loan interest (Section 24b)

✅ You pay high rent and benefit from HRA.

✅ You actively invest in tax-saving instruments.

- New Regime is better for you if:

✅ You don’t invest much in tax-saving schemes.

✅ Your salary structure has fewer exemptions.

✅ You prefer simplicity without paperwork.

✅ Your annual income is up to ₹7 lakh (zero tax with rebate).

5. Case Study Comparison

Case 1 – Salaried Person with Investments

- Salary: ₹12 lakh

- Investments under 80C: ₹1.5 lakh

- 80D: ₹30k

- HRA: ₹1.2 lakh

👉 Old Regime Tax: ~₹1.12 lakh

👉 New Regime Tax: ~₹1.35 lakh

✅ Old Regime better

Case 2 – Salaried Person without Investments

- Salary: ₹9 lakh

- No deductions claimed

👉 Old Regime Tax: ~₹72,800

👉 New Regime Tax: ~₹46,800

✅ New Regime better

6. Conclusion

Both regimes have their pros and cons.

- If you’re disciplined in tax-saving investments, the Old Regime often works better.

- If you’re a young earner, non-investor, or want simplicity, the New Regime is usually better.

💡 Best practice → Use an Income Tax Calculator each year to compare both regimes before filing your ITR.