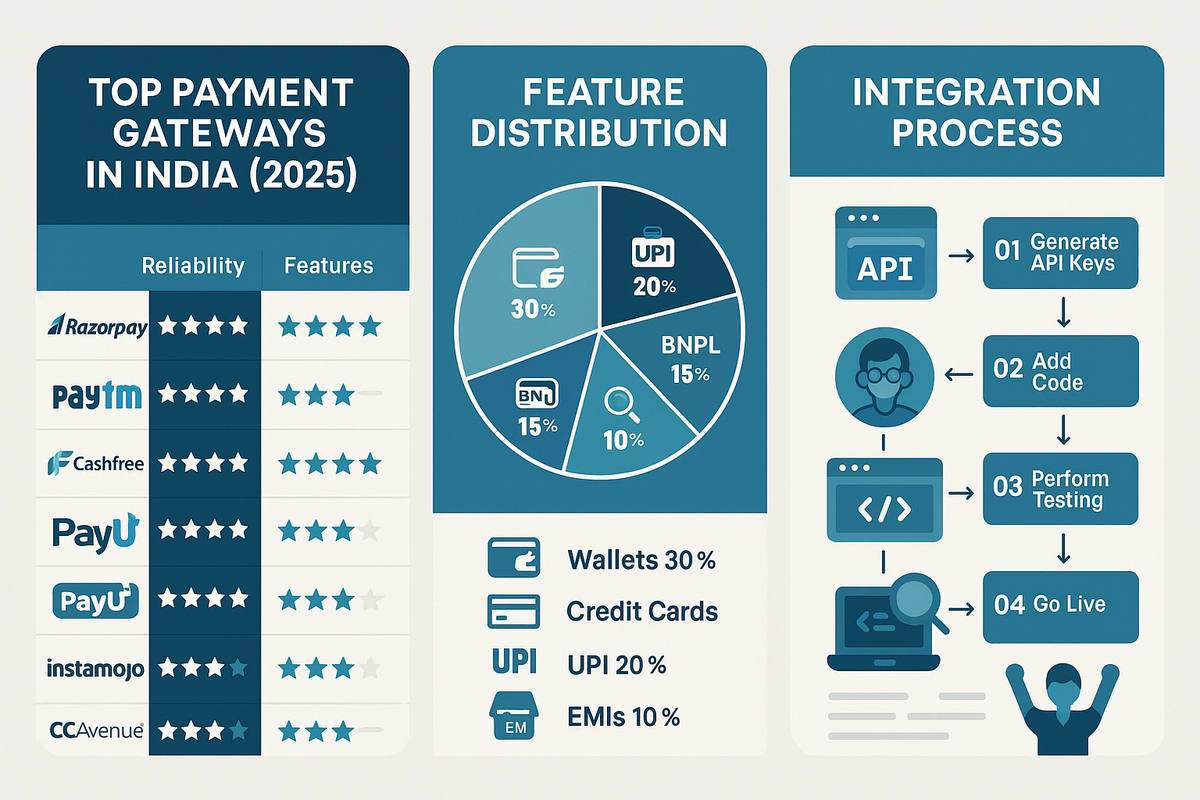

Top Payment Gateways in India 2025: Reliability, Features & Easy Integration

In India’s booming digital economy, choosing the right payment gateway can make or break your online business. With over 18 billion UPI transactions monthly and a projected market size of $2.66 billion by 2029, seamless, secure payment processing is non-negotiable (The Times of India, Aureate Labs). Whether you’re a budding startup or an established enterprise, factors like uptime, feature set, and developer-friendly APIs should guide your decision. Below, we’ve analyzed the top six payment gateways in India for 2025—evaluating their reliability, standout features, and integration ease.

Why the Right Payment Gateway Matters in 2025

- Transaction Success & Uptime: Any downtime or failed payment leads to lost revenue and eroded customer trust. Gateways with 99.9%+ uptime ensure uninterrupted sales.

- Feature Richness: From UPI and wallets to buy-now-pay-later (BNPL) and subscription billing, modern businesses need a diverse toolkit.

- Developer Experience: Well-documented APIs, SDKs, and plug-and-play plugins slash integration time and reduce maintenance headaches.

- Scalability & Support: As your volumes grow, look for auto-retry logic, smart routing, and 24×7 developer support to handle peak loads smoothly.

Top Payment Gateways in India (2025)

Razorpay

- Reliability: 99.9% uptime guarantee backed by AI-powered smart routing that boosts success rates by 4–6% during traffic spikes (Razorpay).

- Key Features:

- Support for Cards, NetBanking, UPI, Wallets, “Pay Later,” and international cards

- AI agent interface with 35+ payment operations

- Stored-card vault with 4 million+ tokens

- Instant settlements via “Smart Collect”

- Integration Ease:

- Pros & Cons:

- ✅ Sleek dashboard, real-time analytics, automatic retries

- ✅ Deep API and webhook support

- ❌ Occasional payout delays on holidays (G2)

Paytm

- Reliability: Claims 100% payment success rate and 99.99% uptime, handling 10,000+ transactions/sec (Aureate Labs).

- Key Features:

- 100+ payment methods: Cards, NetBanking, UPI, Paytm Wallet, Paytm Postpaid, EMIs

- T+1 settlements; instant onboarding (<30 min)

- Pre-built SDKs for mobile app integration

- Real-time dashboard and custom reports

- Integration Ease:

- Plugins for Magento, WooCommerce, PrestaShop, Shopify, Wix

- RESTful APIs with sample code in multiple languages

- Pros & Cons:

- ✅ Zero setup/annual fees, instant activation

- ✅ Advanced 2-click UPI flow

- ❌ Physical KYC verification required (Aureate Labs)

Cashfree

- Reliability: Auto-retry system and 15 min settlement ensure 15% higher success rates (Aureate Labs).

- Key Features:

- 120+ methods: Cards, UPI apps, QR, wallets, BNPL, EMIs

- “Auto-Collect” link generation via WhatsApp, QR, desktop

- PCI-DSS Level 1 compliance, token vault

- Integration Ease:

- REST APIs, JavaScript SDK, PHP/Python libraries

- Plugins for Shopify, WooCommerce, Magento, PrestaShop

- Same-day onboarding; live support

- Pros & Cons:

- ✅ No setup/maintenance fees; holiday settlements

- ✅ Configurable “Offer Engine” for discounts

- ❌ Support ticket delays; no phone support (Aureate Labs)

PayU

- Reliability: Industry-best success rates, powering 150+ payment methods (Aureate Labs).

- Key Features:

- Credit/Debit cards, NetBanking, UPI, wallets, BNPL, EMIs

- T+2 settlements; “API Playground” sandbox

- Subscription billing and retries

- Integration Ease:

- Lightweight SDKs for iOS, Android, React Native

- Plugins for WordPress, Magento, BigCommerce

- 1–day onboarding

- Pros & Cons:

- ✅ Live chat support, real-time testing

- ✅ Customizable checkout UX

- ❌ Slightly higher TDR for international cards (Aureate Labs)

Instamojo

- Reliability: Trusted by 2 million+ merchants; optimized checkout flow reduces abandonment (Aureate Labs).

- Key Features:

- 100+ methods including Google Pay, cards, netbanking, wallets

- Instant “Smart Page” setup; pass convenience fees to customers

- T+3 settlements; built-in SMS/email reminders

- Integration Ease:

- Ionic, Android, iOS SDKs; REST APIs

- WordPress, WooCommerce, Drupal, CS-Cart plugins

- Email-based instant onboarding

- Pros & Cons:

- ✅ Zero setup/withdrawal fees; pay-per-use plans

- ✅ Split-payment and escrow support

- ❌ Slower settlements; annual fees on some plans (Aureate Labs)

CCAvenue

- Reliability: 96.5% success rate with multi-bank routing and retry logic (Aureate Labs).

- Key Features:

- 200+ payment modes: Cards, netbanking, prepaid instruments, EMIs

- iOS/Android SDKs; smartphone POS

- Central Bank Digital Currency (CBDC) support

- Integration Ease:

- Plugins for Magento, OpenCart, Joomla, WordPress

- 1-hour account activation

- Pros & Cons:

- ✅ Free storefront for merchants without a website

- ✅ Multilingual checkout; customizable UI

- ❌ Weekly settlements above ₹1,000; annual maintenance fee (Aureate Labs)

Comparison at a Glance

| Gateway | Uptime/SLA | Key Strength | Integration Time | Standout Feature |

|---|---|---|---|---|

| Razorpay | 99.9% (Razorpay) | AI smart routing | ~30 min | AI agent & stored-card vault |

| Paytm | 99.99% (Aureate Labs) | Instant onboarding, 100% success | <30 min | 2-click UPI & in-app wallets |

| Cashfree | 99.5%+ (auto-retry) (Aureate Labs) | 15 min settlements | Same-day | Offer Engine & holiday payouts |

| PayU | 99%+ (Aureate Labs) | Sandbox & SDKs | 1 day | API Playground |

| Instamojo | 98%+ (Aureate Labs) | Smart Page & pay-link pass-on | Instant | Split payments & escrow |

| CCAvenue | 96.5% (Aureate Labs) | CBDC & multi-bank routing | 1 hour | Free merchant storefront |

How to Choose the Best Gateway for Your Business

- Assess Your Volume & Methods: For UPI-centric or BNPL needs, choose vendors with optimized flows (e.g., Razorpay, Paytm).

- Developer Resources: If rapid, low-code integration is key, Instamojo or Razorpay’s SDKs shine.

- Cost Sensitivity: Startups benefit from zero-fee plans (Instamojo) or competitive TDR (Cashfree, PayKun).

- Global Reach: For cross-border sales, verify international card support and foreign settlement fees.

- Compliance & Security: Ensure PCI DSS compliance and data-tokenization features for fraud mitigation.

Conclusion & Call to Action

Selecting the right payment gateway is a strategic decision that impacts your conversion rates and customer satisfaction. Evaluate your transaction patterns, technical capacity, and feature requirements against the profiles above. Ready to streamline your payments in 2025? Sign up with your preferred gateway today and unlock smoother, faster revenue flows.

FAQ

1. Which payment gateway offers the highest uptime?

Razorpay guarantees 99.9% uptime with AI-driven routing, while Paytm claims 99.99% uptime for enterprise clients (Razorpay, Aureate Labs).

2. Which gateway is easiest to integrate?

Instamojo and Razorpay are renowned for plug-and-play SDKs and one-click plugins, letting you go live in under an hour (Aureate Labs, Capterra).

3. How do transaction fees compare?

Basic UPI transactions are often free on several platforms (Razorpay, Paytm, Cashfree), while cards and wallets typically incur 1.75–3% per transaction plus GST (Aureate Labs).

4. Can I use multiple gateways simultaneously?

Yes—many businesses deploy two or more gateways (e.g., Razorpay Route) to optimize success rates and regional reach (G2).

5. Do these gateways support recurring billing?

Most top gateways (Razorpay, PayU, Paytm) offer subscription-billing modules and automated retries. Check individual API docs for implementation details.