Choosing the right country to build a startup in 2025 is not just about market size, it’s about taxes, funding, visas, regulation, yearly costs, and long-term scalability. Ultimate Startup Destination? Founders today ask a powerful question:

👉 “Where should we REALLY build — India, US, UK, Singapore, or UAE?”

Each region offers massive opportunities, but each also has its own financial and regulatory realities.

This article gives you a full breakdown including:

- Tax Structure

- Registration Formalities

- Yearly Government Costs

- Market Size

- Funding Ecosystem

- Talent Cost

- Pros & Cons

Let’s dive in.

🇮🇳 INDIA – High Talent, Low Cost, Massive Scale

🔹 TAX STRUCTURE (2025)

| Tax Type | Rate |

|---|---|

| Corporate Tax (Small companies) | 22–25% |

| Corporate Tax (Large companies) | 30% |

| Startups (80-IAC) | 3-year tax holiday |

| GST | 18% (variable) |

| Dividend Tax | 10–20% |

Pros (Tax)

✔ Startup tax holidays

✔ Low hiring cost

✔ Incentives for MSME & manufacturing

Cons (Tax)

✘ Complex compliance

✘ GST filings monthly

🔹 REGISTRATION FORMALITIES

- Private Limited / LLP

- Time: 7–15 days

- Documents: PAN, Aadhaar, DSC, MOA/AOA

Ease of Doing Business: Moderate

🔹 YEARLY GOVERNMENT COSTS

| Expense | Cost |

|---|---|

| ROC Filing | ₹3k–₹7k |

| GST & IT Compliance | ₹20k–₹70k |

| Auditor | ₹30k–₹1 lakh |

| PF/ESI Mandatory | Yes |

👉 Annual Cost: ₹50,000 – ₹3,00,000+

🔹 Best For

- SaaS

- FinTech

- EdTech

- B2C consumer apps

🇺🇸 UNITED STATES – The Global Capital of Venture Funding

🔹 TAX STRUCTURE (2025)

| Tax Type | Rate |

|---|---|

| Federal Corporate Tax | 21% |

| State Tax | 0–12% |

| Personal Income Tax | 10–37% |

| Sales Tax | 0–10% |

Delaware C-Corp is the global standard for VC-backed startups.

🔹 REGISTRATION

- Set up a Delaware C-Corp in 1–3 days

- Documents required: Passport, EIN, Operating Agreement

Ease of Doing Business: High (but regulated)

🔹 YEARLY GOVERNMENT COSTS

| Expense | Cost |

|---|---|

| Delaware Franchise Tax | $300 – $5,000 (varies) |

| Registered Agent | $50 – $300 |

| CPA & Compliance | $1,000 – $5,000 |

| Business Licenses | $200 – $1,000 |

👉 Annual Cost: $2,000 – $10,000+

🔹 Best For

- VC-backed startups

- DeepTech, AI, Healthcare

- Startups needing US market access

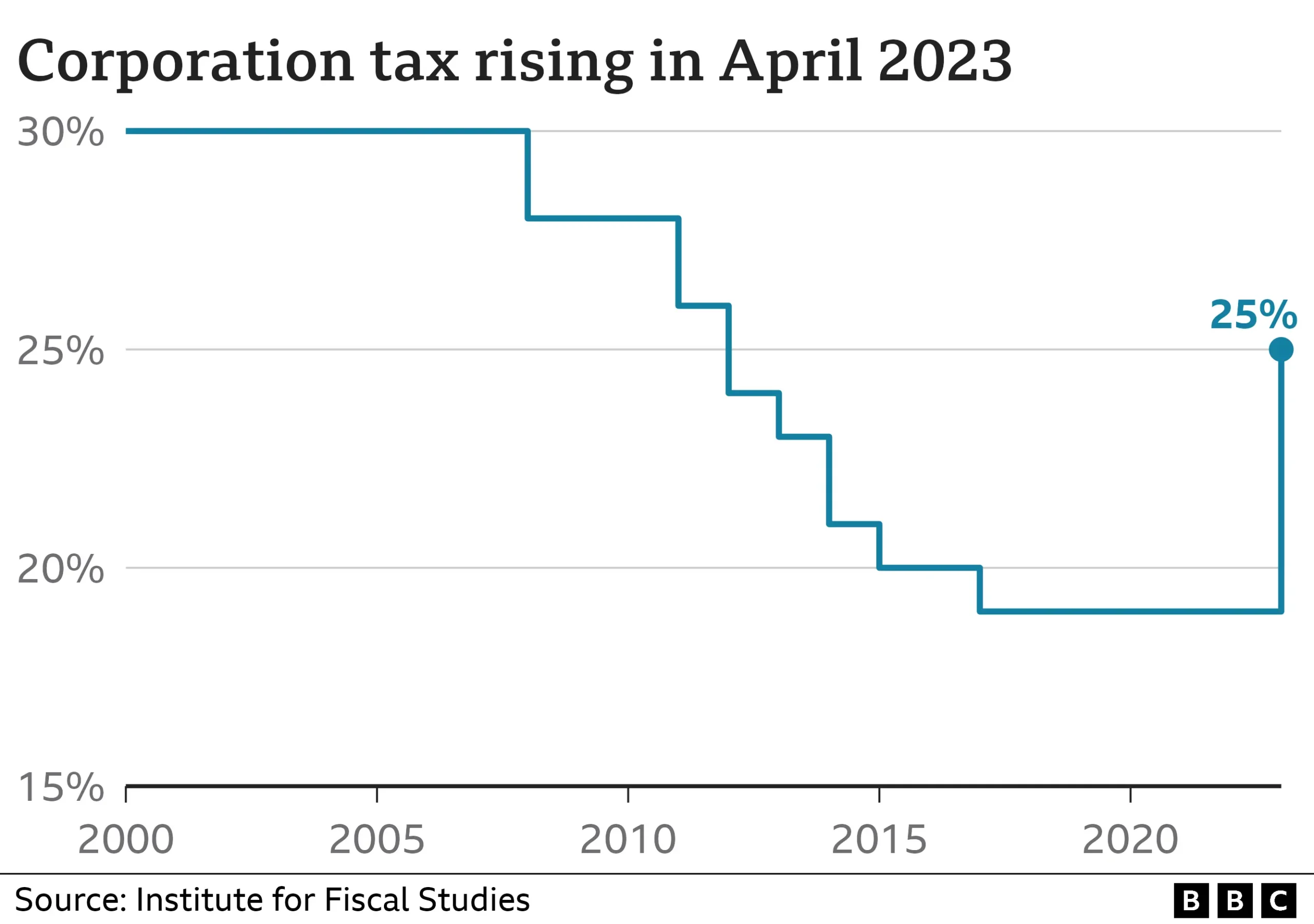

🇬🇧 UNITED KINGDOM – Stable, Professional, Globally Connected

🔹 TAX STRUCTURE

| Tax Type | Rate |

|---|---|

| Corporate Tax | 25% |

| VAT | 20% |

| Dividend Tax | 8.75–33.75% |

| Personal Tax | 20–45% |

🔹 REGISTRATION FORMALITIES

- Companies House

- Time: 24–48 hours

- 100% online registration

Ease of Doing Business: Very High

🔹 YEARLY GOVERNMENT COSTS

| Expense | Cost |

|---|---|

| Confirmation Statement | £13 |

| Annual Accounts Filing | £200–£500 |

| Accountant Fees | £800–£3,000 |

| VAT compliance | Required |

👉 Annual Cost: £1,000 – £5,000

🔹 Best For

- FinTech

- AI & DeepTech

- Companies targeting Europe

- Regulated industries

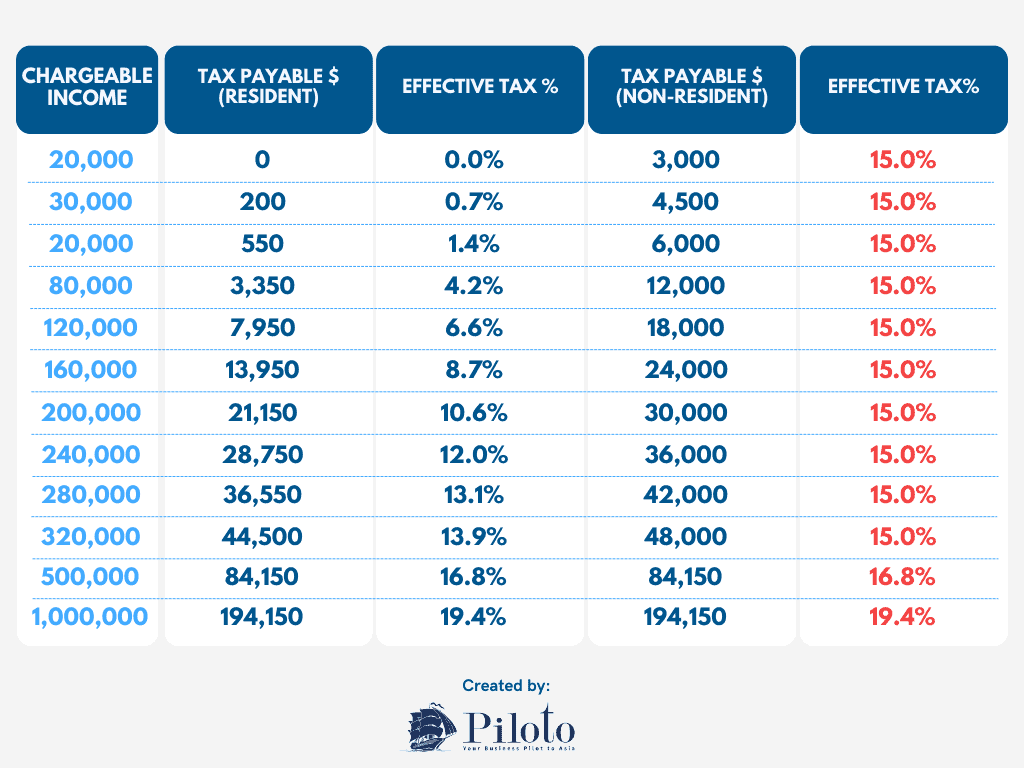

🇸🇬 SINGAPORE – The World’s Most Business-Friendly Startup Hub

🔹 TAX STRUCTURE

| Tax Type | Rate |

|---|---|

| Corporate Tax | 17% |

| Tax Exemption (first 3 years) | 75% on first SGD 100k |

| GST | 9% |

| Personal Income Tax | 0–22% |

Singapore offers some of the strongest startup grants globally.

🔹 REGISTRATION FORMALITIES

- ACRA registration

- Setup time: 1–2 days

- Need a local director (can be nominee)

Ease of Doing Business: Excellent

🔹 YEARLY GOVERNMENT COSTS

| Expense | Cost |

|---|---|

| Filing Fees | SGD 60 – 300 |

| Secretary (mandatory) | SGD 600 – 1,000 |

| Nominee Director | SGD 1,500 – 3,000 |

| Accounting | SGD 1,000 – 3,000 |

👉 Annual Cost: SGD 3,000 – 6,000

🔹 Best For

- Global SaaS

- FinTech

- Logistics & Trade companies

- APAC headquarters

🇦🇪 UAE (Dubai) – Zero Tax + Fastest Setup + Global HQ Choice

🔹 TAX STRUCTURE

| Tax Type | Rate |

|---|---|

| Corporate Tax | 0% up to AED 375k, then 9% |

| Personal Income Tax | 0% |

| VAT | 5% |

🔹 REGISTRATION FORMALITIES

- Free Zone or Mainland

- Company setup in 2–5 days

- 100% foreign ownership allowed

Ease of Doing Business: Very High

🔹 YEARLY GOVERNMENT COSTS

| Expense | Cost |

|---|---|

| License Renewal | AED 8,000 – 20,000 |

| Visa Renewal | AED 3,500 – 7,000 |

| Office Lease | AED 10,000 – 30,000 |

| Accounting | AED 2,000 – 10,000 |

👉 Annual Cost: AED 20,000 – 60,000

🔹 Best For

- Global HQ

- FinTech, Web3, AI

- GCC market expansion

🆚 FINAL COMPARISON TABLE (2025)

| Feature | India | US | UK | Singapore | UAE |

|---|---|---|---|---|---|

| Corporate Tax | Medium | Medium | High | Low | Very Low |

| Registration Speed | Medium | Fast | Very Fast | Very Fast | Fastest |

| Annual Government Cost | Low | High | Medium | Medium | Medium-High |

| Funding Availability | High | Very High | High | High | High |

| Talent Cost | Low | Very High | High | High | Medium |

| Market Size | Very Large | Very Large | Medium | Medium | Medium |

| Best For | Product Startups | VC Tech | FinTech | HQ & SaaS | HQ & GCC |

🎯 Conclusion Which Country Should You Choose?

✔ Choose INDIA if

You want talent + affordability + massive user scale.

✔ Choose US if

You need VC funding + global brand + enterprise deals.

✔ Choose UK if

You need European access + regulated industry credibility.

✔ Choose SINGAPORE if

You want APAC HQ + low tax + stable global business base.

✔ Choose UAE if

You want 0% personal tax + fast setup + GCC expansion.

❓ FAQs

1. Which country is the cheapest for startups?

India – lowest hiring and compliance costs.

2. Which country has the lowest taxes?

UAE – 0% income tax + low corporate tax.

3. Which country offers the most startup grants?

Singapore – strong government-funded innovation schemes.

4. Which is best for high-growth VC-backed startups?

The United States – strongest venture capital ecosystem.

5. Can a startup operate in multiple countries?

Yes – many founders use a hybrid model:

📌 Build in India → HQ in Dubai/Singapore → Raise in US/UK.